Housing Market Forecast for 2017 – Trump Presidency & FHA

- Posted by Cecilia Sherrard

- Posted on January 24, 2017

- Cleveland Real Estate, Cleveland Real Estate Market, FHA Mortgage Financing, Ohio Real Estate

- No Comments.

With the new Trump presidency and cabinet now in place, what will the housing market look like for 2017? There have been some predictions and some unknowns. Coming off a strong 2016 real estate market, we’re slowly seeing a slight change in interest rates and rising property values. So what’s to come? Will Donald Trump’s presidency and policies change the housing market and the growth we’ve seen?

Consumer confidence and the stock market showed positive signs after the election of now-President Donald Trump. Fannie Mae is maintaining a conservative forecast for 2017. According to Fannie Mae’s economic and strategic research group, the economic growth projection is predicted to be 2%.

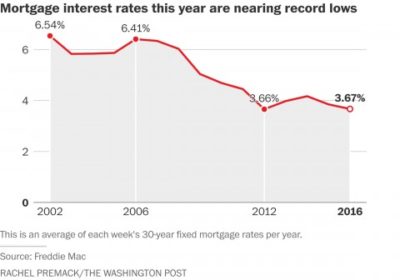

We’ll get a better glimpse of policy changes and the plans for this new White House now that the festivities are over. The president and his new cabinet are starting their new positions, and they have a lot of changes and new ideas to implement. Improved consumer spending, a friendly labor market and rising household wealth should continue to support consumers. Fannie Mae also pointed out that government spending and inventory investment will add to growth in 2017. Mortgage rates should rise slowly throughout the year to 4.3%, but there is still a risk that rates will rise faster and higher than the forecast. It’s hard to read the political tea leaves so early on. There are a lot of variables and contributors to the housing market, jobs, trade, the value of the dollar, consumer spending, international conflict, etc.

Dr. Ben Carson being appointed the HUD Secretary is an interesting choice, as was the immediate suspension of the FHA mortgage premium cut on President Trump’s first day as president. Keeping tabs on the first-time home buyer market and keeping FHA buyers on board will be crucial to keeping a strong and steady real estate market. Without first-time home buyers, second timers aren’t able to move-up, etc. It’s really a necessary cycle that begins with the first-time buyer, middle class, and those without the greatest wealth. That’s the level of the chain where growth either starts or stops.

Some have argued this past week that the average savings of $500 a year that President Trump suspended is a good thing, and home buyers that are affected by this savings likely shouldn’t be buying homes to begin with. I’ve read a lot of really backwards and awful things, as most of us have. Some have supported the suspension and strongly argued that high-risk buyers (those not putting at least 20% down with a 720+ credit score), are the reason the housing market crashed previously. This is simply not true.

The reason that the housing market crashed was due to high-risk loans being given to buyers that didn’t need to show verification, didn’t have to put a single dollar down, and some even getting cash at closing, etc. Those loans should have never been given to home buyers in the first place. The banks practiced the high-risk gamble, but they got bailed out leaving the real estate market and home owners in shambles. There were many loans previously given with an adjustable rate mortgage (ARM), and many home buyers lost their homes when their mortgage payments increased dramatically. When neighbors lose their homes and foreclose, values in the area go down, making equity shrink and less home owners being able to sell. That’s my best attempt at a brief synopsis covering the reasons why the housing market crashed almost decade ago.

FHA loans are a vital part of our housing market and are not a part of the previous high-risk loan scenarios. You must have a current job. You must have had a job for at least two years. You must have a credit score of at least 580-620+. Everything is verified. There are no more $0 down loans. With FHA, you are putting down 3.5% of the purchase price. The $500 mortgage insurance credit that was just suspended was just a way to help average home owners save a few dollars a year on what they’re paying extra on already.

FHA is a great loan product and option for many first-time home buyers. It’s an affordable way to own a home and get out of the rental cycle. FHA buyers are a huge part of our neighborhoods and local real estate markets.

So what does 2017 have in store for the real estate market in general? It’s hard to predict without knowing what other plans the current White House has. A lot will depend on drastic changes or if they maintain the status quo. Serious delinquency rates on single-family homes are down to 4.5% from 7% in 2008 and 10% in 2011. We’re at the lowest we have been since 2008. The average credit score has risen from 620 in 2008 to 680 today. Many home buyers that foreclosed on a home previously are now able to buy a home again.

Naturally, every market around the country is unique, as are housing prices and trends. In Northeast Ohio, we’ve seen an increase in home values, buyer ability and low interest rates. Oddly enough, it’s almost a market for all. A buyer’s market and a seller’s market at the same time. Many sellers that were “stuck” in the previous years are now finally able to sell and move up. My personal prediction for the Cleveland, Ohio, area is that we’ll see a steady, continued growth with more current home owners jumping on the selling wagon that’s finally come around. New home buyers will continue to enter the market to get out of the high-rent cycle they’ve been in. Since the housing crash nearly a decade ago, the rental market increased. High demand for rentals made it more expensive to rent than to now own. Remember, even with interest rates slightly rising to 4.3%, they were above 6% 10 years ago.

If you’re considering buying or selling a home in the Cleveland, Ohio area, contact me anytime via email to discuss your options and goals. I assist home buyers and sellers in all income ranges, cities and situations. I work with the best lenders and experts in the area. After fourteen years in the business, I’ve narrowed down the best of the best. It really makes a huge difference when you work with the right people. View my Bio, search all homes for sale on this site using my Ohio MLS search, download my RE/MAX Home Search app for Android here, or simply call me and let’s chat. 216-323-4620.

Follow me on Facebook, Twitter and Instagram to stay connected and for great tips, news and information.

Search:

Archives

- August 2021

- May 2021

- March 2021

- July 2020

- June 2020

- April 2020

- August 2019

- May 2019

- February 2019

- October 2018

- March 2018

- January 2018

- December 2017

- October 2017

- September 2017

- June 2017

- April 2017

- February 2017

- January 2017

- December 2016

- October 2016

- September 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- January 2016

- November 2015

- June 2015

- May 2015

- April 2015

- February 2015

- November 2014

- January 2014

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- October 2012

- September 2012

- May 2012

- March 2012

- February 2012

- November 2011

- October 2011

- September 2011

- August 2011

- June 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

Categories

- Activities in Ohio

- Akron Ohio Real Estate

- Auburn Ohio Real Estate

- Aurora Ohio Real Estate

- Avon Lake Ohio Real Estate

- Avon Ohio Real Estate

- Bainbridge Ohio Real Estate

- Bank Owned Homes For Sale in Ohio

- Barberton Ohio Real Estate

- Bath Ohio Real Estate

- Bay Village Ohio Real Estate

- Beachwood Ohio real Estate

- Bedford Ohio Real Estate

- Berea Ohio RE/MAX Office

- Berea Ohio Real Estate

- Bratenahl Ohio Real Estate

- Brecksville Ohio Real Estate

- Broadview Heights Ohio Real Estate

- Brook Park Ohio Real Estate

- Brooklyn Real Estate

- Brunswick Ohio Real Estate

- Burton Ohio Real Estate

- Buying A Home in Ohio

- Chagrin Falls Ohio Real Estate

- Chardon Ohio Real Estate

- Chesterland Ohio Real Estate

- Chippewa Lake Ohio Real Estate

- Cleaning Tips

- Cleveland Condos For Sale

- Cleveland Heights Ohio Real Estate

- Cleveland Information

- Cleveland Investment Property

- Cleveland Real Estate

- Cleveland Real Estate Market

- Cleveland Social Media

- Commercial Property For Sale in Ohio

- Concord Ohio Real Estate

- Copley Ohio Real Estate

- Cuyahoga Falls Ohio Rea lEstate

- Downtown Cleveland Ohio

- Duplexes For Sale in Cleveland Ohio

- Eastlake Ohio Real Estate

- Elyria Ohio Real Estate

- Euclid Ohio Real Estate

- Fairview Park Ohio Real Estate

- FHA Mortgage Financing

- Garfield Heights Ohio Real Estate

- Gates Mills Ohio Real Estate

- Geauga County Ohio Homes For Sale

- Gold Coast Condos

- Green Living

- Highland Heights Ohio Real Estate

- Hinckley Ohio Real Estate

- Hiram Ohio Real Estate

- Home Buyer Assistance

- Home Repairs

- Homeowners Insurance

- Homerville Ohio Real Estate

- Homes in Barrington Golf Course Aurora Ohio

- HUD Homes For Sale in Ohio

- Hudson Ohio Real Estate

- Hunting Hills Ohio Real Estate

- Independence Ohio Real Estate

- Investment Property

- Kent Ohio Real Estate

- Lakewood Ohio Real Estate

- Land For Sale in Ohio

- Lodi Ohio Real Estate

- Lorain Ohio Real Estate

- Lyndhurst Ohio Homes For Sale

- Lyndhurst Ohio Real Estate

- Macedonia Ohio Real Estate

- Maple Heights Ohio Real Estate

- Mayfield Heights Ohio Real Estate

- Mayfield Hieghts Ohio Real Estate

- Mayfield Village Ohio Real Estate

- Medina Ohio Real Estate

- Mentor Ohio Real Estate

- Middleburg Heights Ohio Real Estate

- Million Dollar Homes in Ohio

- Mogadore Ohio Real Estate

- Money Saving Tips

- Montville Ohio Real Estate

- Moreland Hill Ohio Real Estate

- Mortgage Home Loan Information

- Moving Tips/Assistance

- Multi-Family homes for sale in Ohio

- Munson Ohio Real Estate

- New Ohio Homes For Sale

- Newbury Ohio Real Estate

- North Olmsted Ohio Real Estate

- North Ridgeville Ohio Real Estate

- North Royalton Ohio Real Estate

- Ohio Bank Owned Homes For Sale

- Ohio Commercial Real Estate

- Ohio Home Selling

- Ohio Homes With Extra Garage Space

- Ohio HUD Homes For Sale

- Ohio Luxury Real Estate

- Ohio Real Estate

- Ohio Rental Property

- Ohio Schools

- Olmsted Falls Ohio Real Estate

- Painesville Ohio Real Estate

- Parma Heights

- Parma Ohio Real Estate

- Pepper Pike Ohio Real Estate

- Perry Ohio Real Estate

- Ravenna Ohio Real Estate

- RE/MAX Ohio Realtors

- RE/MAX Rocky River Ohio

- Recipe

- Relocating to Ohio

- Rental Property in Cleveland

- Richfield Ohio Real Estate

- Richmond Heights Ohio Real Estate

- Rocky River Ohio Real Estate

- Rootstown Ohio Real Estate

- Sagamore Hills Ohio Real Estate

- Selling A Home In Ohio

- Seven Hills Ohio Real Estate

- Shaker Heights Ohio Real Estate

- Sheffield Ohio Real Estate

- Solon Ohio Homes For Sale

- South Amherst Ohio Real Estate

- South Euclid Ohio Real Estate

- South Russell Ohio Real Estate

- Stow Ohio Real Estate

- Streetsboro Ohio Homes For Sale

- Strongsville Ohio RE/MAX

- Strongsville Ohio Real Estate

- Three Family Homes For Sale Lakewood Ohio

- Twinsburg Ohio Real Estate

- Two-Family Homes For Sale in Cleveland

- Uncategorized

- University Heights Ohio Real Estate

- Valley City Ohio Real Estate

- Vermilion Ohio Real Estate

- Wadsworth Ohio Real Estate

- West Park Ohio Real Estate

- Westlake Ohio Real Estate

- Wickliffe Ohio Real Estate

- Willoughby Ohio Real Estate

- Willowick Ohio Real Estate