Should You Close Your Credit Cards? Will It Hurt Your Credit Rating?

- Posted by Cecilia Sherrard

- Posted on June 13, 2013

- Cleveland Real Estate, Home Buyer Assistance, RE/MAX Ohio Realtors

- No Comments.

You may have numerous credit cards that you aren’t using and have no balance. Some may be old, credit cards that you opened just to save at the time of your purchase and some that you just don’t want to use anymore for whatever reason. You may have worked hard paying your cards off and feel great about not having anymore debt on these cards. The question is, to close or not to close? Should you close credit card accounts if you’re not using the card anymore? Will closing your credit card hurt your credit score/rating? The answer is most always, YES! Closing your credit card accounts will have a negative impact on your credit score… if you still need a good credit score to buy a big ticket item like a car, home or loan.

The major credit bureaus want to see that you have available credit. The more available credit you have, the better. Each credit card you have adds to that number. If you have say, 6 extra credit cards that you’re not using and they total thousands of dollars of available credit, this is a good thing and keeps your ratio low. This tells the credit scoring companies that you are not “strapped” for credit or desperate. A desperate borrower is a risk. Most banks do not want to take on that risk. You could take a hit on your credit score by closing any account you have and lowering your “available credit” amount.

So, you have these credit cards that have $0 balance, but you’re not using them. Why keep them? Well for one, the age of the established credit will help strengthen your credit score. The longer you have credit, the higher you rank. The older, the better. Closing a credit card that is old hurts more than a newer line of credit. The longer you have a credit card, the better chance you have of them increasing your credit as most companies increase in increments throughout the years. This builds your available credit amount which as you read above is important! It shows that you have many lines of credit and do not need them. This shows confidence, stability, trust and responsibility. Those are the main factors that determine the behind the scenes opinion when determining your score and decisions by creditors.

What if your credit cards have a yearly fee? Isn’t it wise to close them if you’re not using them? Perhaps, but not always! You will need to determine the best option for your life, needs and future. For example, if you will need more credit down the road perhaps you will be buying a home, a car or other large ticket items, you will want to get a good interest rate and be approved. Your current credit cards help keep your credit rating high so that you will qualify for the best loans available. Getting a low interest rate could save you a lot more in the long run than a few monthly or yearly fees attached to your existing credit card accounts.

If you are settled in your life with no expected large purchases, you may not need the best of the best credit score. It may be wise to close your accounts if you are okay with your credit rating going down. Make sure you have all your life needs covered first. Obviously we never know what will come up or what surprises our life will be dealt, but if you’re confident that you won’t be making any more large purchases that require financing, saving the yearly or monthly fees associated with your lines of credit will be more beneficial.

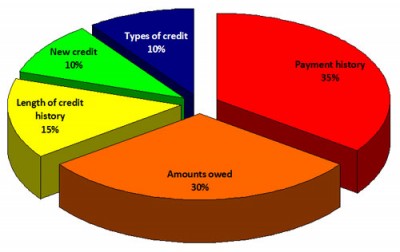

Credit Score Breakdown – Payment History, New Credit, Amount Owed, Type of Credit and Credit History

What should you do with all these credit cards that you aren’t using? The best thing to do to boost your credit score is use these cards every six months or so. Use them all at or around the same time. Make very small purchases on them. Any amount will do! Pay them all off right away. If you do this a couple times a year, you will dramatically increase your credit score. Why? It shows that you are active, current, still responsible, and still don’t need all of your credit line. It adds to your payment history which is the most important part of your credit score. Those on-time payments and using them will continue to give you a huge boost to your credit rating sometimes up to 100 points!

Keep your credit cards in a secure place if you’re not using them and review them occasionally. Make sure you keep up with the terms of service for each card so that there are no changes that could hurt you like a minimum yearly purchase or a new fee added that you miss. Also review them occasionally for due dates. Sometimes credit card companies change your due date. This could seriously hurt your score if you miss a payment or pay late.

As always, if you need assistance with building good credit, obtaining a home loan, or buying or selling a home, I’m always here to help! Contact me anytime with credit questions, to get pre-approved for a mortgage or to start the home buying process.

Search:

Archives

- August 2021

- May 2021

- March 2021

- July 2020

- June 2020

- April 2020

- August 2019

- May 2019

- February 2019

- October 2018

- March 2018

- January 2018

- December 2017

- October 2017

- September 2017

- June 2017

- April 2017

- February 2017

- January 2017

- December 2016

- October 2016

- September 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- January 2016

- November 2015

- June 2015

- May 2015

- April 2015

- February 2015

- November 2014

- January 2014

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- October 2012

- September 2012

- May 2012

- March 2012

- February 2012

- November 2011

- October 2011

- September 2011

- August 2011

- June 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

Categories

- Activities in Ohio

- Akron Ohio Real Estate

- Auburn Ohio Real Estate

- Aurora Ohio Real Estate

- Avon Lake Ohio Real Estate

- Avon Ohio Real Estate

- Bainbridge Ohio Real Estate

- Bank Owned Homes For Sale in Ohio

- Barberton Ohio Real Estate

- Bath Ohio Real Estate

- Bay Village Ohio Real Estate

- Beachwood Ohio real Estate

- Bedford Ohio Real Estate

- Berea Ohio RE/MAX Office

- Berea Ohio Real Estate

- Bratenahl Ohio Real Estate

- Brecksville Ohio Real Estate

- Broadview Heights Ohio Real Estate

- Brook Park Ohio Real Estate

- Brooklyn Real Estate

- Brunswick Ohio Real Estate

- Burton Ohio Real Estate

- Buying A Home in Ohio

- Chagrin Falls Ohio Real Estate

- Chardon Ohio Real Estate

- Chesterland Ohio Real Estate

- Chippewa Lake Ohio Real Estate

- Cleaning Tips

- Cleveland Condos For Sale

- Cleveland Heights Ohio Real Estate

- Cleveland Information

- Cleveland Investment Property

- Cleveland Real Estate

- Cleveland Real Estate Market

- Cleveland Social Media

- Commercial Property For Sale in Ohio

- Concord Ohio Real Estate

- Copley Ohio Real Estate

- Cuyahoga Falls Ohio Rea lEstate

- Downtown Cleveland Ohio

- Duplexes For Sale in Cleveland Ohio

- Eastlake Ohio Real Estate

- Elyria Ohio Real Estate

- Euclid Ohio Real Estate

- Fairview Park Ohio Real Estate

- FHA Mortgage Financing

- Garfield Heights Ohio Real Estate

- Gates Mills Ohio Real Estate

- Geauga County Ohio Homes For Sale

- Gold Coast Condos

- Green Living

- Highland Heights Ohio Real Estate

- Hinckley Ohio Real Estate

- Hiram Ohio Real Estate

- Home Buyer Assistance

- Home Repairs

- Homeowners Insurance

- Homerville Ohio Real Estate

- Homes in Barrington Golf Course Aurora Ohio

- HUD Homes For Sale in Ohio

- Hudson Ohio Real Estate

- Hunting Hills Ohio Real Estate

- Independence Ohio Real Estate

- Investment Property

- Kent Ohio Real Estate

- Lakewood Ohio Real Estate

- Land For Sale in Ohio

- Lodi Ohio Real Estate

- Lorain Ohio Real Estate

- Lyndhurst Ohio Homes For Sale

- Lyndhurst Ohio Real Estate

- Macedonia Ohio Real Estate

- Maple Heights Ohio Real Estate

- Mayfield Heights Ohio Real Estate

- Mayfield Hieghts Ohio Real Estate

- Mayfield Village Ohio Real Estate

- Medina Ohio Real Estate

- Mentor Ohio Real Estate

- Middleburg Heights Ohio Real Estate

- Million Dollar Homes in Ohio

- Mogadore Ohio Real Estate

- Money Saving Tips

- Montville Ohio Real Estate

- Moreland Hill Ohio Real Estate

- Mortgage Home Loan Information

- Moving Tips/Assistance

- Multi-Family homes for sale in Ohio

- Munson Ohio Real Estate

- New Ohio Homes For Sale

- Newbury Ohio Real Estate

- North Olmsted Ohio Real Estate

- North Ridgeville Ohio Real Estate

- North Royalton Ohio Real Estate

- Ohio Bank Owned Homes For Sale

- Ohio Commercial Real Estate

- Ohio Home Selling

- Ohio Homes With Extra Garage Space

- Ohio HUD Homes For Sale

- Ohio Luxury Real Estate

- Ohio Real Estate

- Ohio Rental Property

- Ohio Schools

- Olmsted Falls Ohio Real Estate

- Painesville Ohio Real Estate

- Parma Heights

- Parma Ohio Real Estate

- Pepper Pike Ohio Real Estate

- Perry Ohio Real Estate

- Ravenna Ohio Real Estate

- RE/MAX Ohio Realtors

- RE/MAX Rocky River Ohio

- Recipe

- Relocating to Ohio

- Rental Property in Cleveland

- Richfield Ohio Real Estate

- Richmond Heights Ohio Real Estate

- Rocky River Ohio Real Estate

- Rootstown Ohio Real Estate

- Sagamore Hills Ohio Real Estate

- Selling A Home In Ohio

- Seven Hills Ohio Real Estate

- Shaker Heights Ohio Real Estate

- Sheffield Ohio Real Estate

- Solon Ohio Homes For Sale

- South Amherst Ohio Real Estate

- South Euclid Ohio Real Estate

- South Russell Ohio Real Estate

- Stow Ohio Real Estate

- Streetsboro Ohio Homes For Sale

- Strongsville Ohio RE/MAX

- Strongsville Ohio Real Estate

- Three Family Homes For Sale Lakewood Ohio

- Twinsburg Ohio Real Estate

- Two-Family Homes For Sale in Cleveland

- Uncategorized

- University Heights Ohio Real Estate

- Valley City Ohio Real Estate

- Vermilion Ohio Real Estate

- Wadsworth Ohio Real Estate

- West Park Ohio Real Estate

- Westlake Ohio Real Estate

- Wickliffe Ohio Real Estate

- Willoughby Ohio Real Estate

- Willowick Ohio Real Estate